JOHNSON & JOHNSON REGISTERED SHARES DL 1

Technische Signale

| Signale Details | |

|---|---|

| WKN / ISIN | - / US4781601046 |

| Börse | Stuttgart |

| Schluss | 135,10 |

| Konservatives Signal | |

| MACD | |

| Momentum | |

| Bollinger Bands | |

| TBI | |

| Schnitt GD 90 |

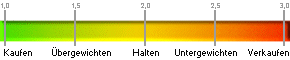

Analystenbewertung

| Bewertungstrend | aktuell | Vorwoche | Vormonat |

|---|---|---|---|

| Bewertung | 2,21 | 2,21 | 2,25 |

| Anzahl der Analysten | 24 | 24 | 24 |

| Kaufen | 8 | 8 | 7 |

| Übergewichten | 3 | 3 | 4 |

| Halten | 13 | 13 | 13 |

| Untergewichten | 0 | 0 | 0 |

| Verkaufen | 0 | 0 | 0 |

| Aktueller Durchschnitt von insgesamt 24 Analysten: 2,21 | |||

| Planzahlen (in EUR) | 2024 | 2025(e) | 2026(e) |

|---|---|---|---|

| Umsatz | 88,82 Mrd. | 91,39 Mrd. | 95,16 Mrd. |

| EBIT | 13,77 Mio. | 29,85 Mrd. | 31,53 Mrd. |

| EBITDA | 20,04 Mio. | 33,19 Mrd. | 34,86 Mrd. |

| Nettoverschuldung** | 11,26 Mrd. | 4,81 Mrd. | -6.527.730.000 |

Umsatz |

EBIT |

EBITDA |

Nettoverschuldung** |

| Dividende | 2024 | 2025(e) | 2026(e) |

|---|---|---|---|

| Dividende / Aktie | 4,20 EUR | 5,25 USD | 5,40 USD |

| Dividendenrendite | 3,10% | 3,36% | 3,45% |

Dividende / Aktie (in USD) |

Dividendenrendite (in %) |

||

| Analystenhäuser |

|---|

| Argus Research Company,Atlantic Equities LLP,Axia Financial Research,Baptista Research,Barclays,BMO Capital Markets Equity Research,BofA Global Research,Brean Capital,BTIG,Canaccord Genuity,Cantor Fitzgerald & Co.,CFRA Equity Research,China Merchants Securities (HK) Co., Ltd,Citigroup Inc,Citizens JMP Securities, LLC,CL King & Associates, Inc.,Credit Suisse,Crisp Idea,Daiwa Capital Markets America Inc.,Daiwa Securities Co. Ltd.,Davenport & Company,Deutsche Bank,Eleven Financial Research,Equisights,Erste Group Bank AG,Eugene Investment & Securities Co Ltd.,Financiële Diensten Amsterdam,First Global Stockbroking (P) Ltd.,Freedom Broker,G. Research, LLC,Goldman Sachs,Guggenheim Securities, LLC,Hanwha Investment & Securities Co., Ltd.,Hilliard Lyons,HSBC,Inside Research S.A.,J.P. Morgan,Jefferies LLC,KB Securities Co., Ltd.,Landesbank Baden-Wuerttemberg Equity and Fixed Income Research,Leerink Partners LLC,Morgan Keegan & Company,Morgan Stanley,Morningstar Inc.,NOBLE Capital Markets, Inc.,Oppenheimer & Co. Inc.,Piper Sandler Companies,Raymond James & Associates,RBC Capital Markets,Rothschild & Co Redburn,Sanford C. Bernstein & Co., LLC,Shinhan Investment Corp.,Societe Generale Cross Asset Research,SSIF Tradeville SA,Stifel, Equities Research,TD Cowen,Truist Securities,UBS Investment Bank,Valuation & Research Specialists,Wells Fargo Securities, LLC,Wolfe Research, LLC.,Yuanta Research,Zephirin Group, Inc. |

| Hinweis |

|---|

|

Selected Data supplied by Standard & Poors

* Unabhängige Schätzung (Gewinnwachstum (in %)) ** Nettobargeldbestand bei negativen Schätzungen |