CISCO SYSTEMS INC. REGISTERED SHARES DL-,001

Technische Signale

| Signale Details | |

|---|---|

| WKN / ISIN | - / US17275R1023 |

| Börse | Berlin |

| Schluss | 51,30 |

| Konservatives Signal | |

| MACD | |

| Momentum | |

| Bollinger Bands | |

| TBI | |

| Schnitt GD 90 |

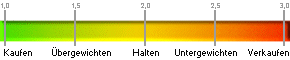

Analystenbewertung

| Bewertungstrend | aktuell | Vorwoche | Vormonat |

|---|---|---|---|

| Bewertung | 2,32 | 2,29 | 2,37 |

| Anzahl der Analysten | 28 | 28 | 27 |

| Kaufen | 8 | 9 | 8 |

| Übergewichten | 3 | 2 | 1 |

| Halten | 17 | 17 | 18 |

| Untergewichten | 0 | 0 | 0 |

| Verkaufen | 0 | 0 | 0 |

| Aktueller Durchschnitt von insgesamt 28 Analysten: 2,32 | |||

| Planzahlen (in EUR) | 2024 | 2024(e) | 2025(e) |

|---|---|---|---|

| Umsatz | 53,80 Mrd. | 53,70 Mrd. | 55,87 Mrd. |

| EBIT | 10,91 Mio. | 18,31 Mrd. | 18,33 Mrd. |

| EBITDA | 13,21 Mio. | 20,21 Mrd. | 20,48 Mrd. |

| Nettoverschuldung** | -16.289.200.000 | 10,33 Mrd. | 12,26 Mrd. |

Umsatz |

EBIT |

EBITDA |

Nettoverschuldung** |

| Dividende | 2024 | 2024(e) | 2025(e) |

|---|---|---|---|

| Dividende / Aktie | 1,45 EUR | 1,57 USD | 1,62 USD |

| Dividendenrendite | 2,84% | 2,84% | 2,92% |

Dividende / Aktie (in USD) |

Dividendenrendite (in %) |

||

| Analystenhäuser |

|---|

| ACI Research,Arete Research Services LLP,Argus Research Company,Atlantic Equities LLP,Auriga USA LLC,Avondale Partners,Axia Financial Research,B. Riley Wealth,Baird,Baptista Research,Barclays,Berenberg,BMO Capital Markets Equity Research,BMO Capital Markets U.S. (Historical),BNP Paribas Exane,BofA Global Research,Buckingham Research Group Inc.,Canaccord Genuity,Cantor Fitzgerald & Co.,Capstone Investments,Caris & Company,CFRA Equity Research,China Merchants Securities Co. Ltd.,Citic Securities Co., Ltd.,Citigroup Inc,Cleveland Research Company,CLSA,Collins Stewart LLC,Credit Suisse,Crisp Idea,CRT Capital Group,Daiwa Capital Markets America Inc.,Daiwa Securities Co. Ltd.,Davenport & Company,Deutsche Bank,Drexel Hamilton,Dz Bank Ag,Equisights,Erste Group Bank AG,Eugene Investment & Securities Co Ltd.,Evercore ISI,FBN Securities, Inc.,FBR Capital Markets & Co.,Financiële Diensten Amsterdam,First Global Stockbroking (P) Ltd.,Gleacher & Company, Inc.,Global Equities Research,Goldman Sachs,Guggenheim Securities, LLC,HSBC,ISI Group Inc.,J.P. Morgan,Janney Montgomery Scott LLC,Jefferies LLC,JMP Securities,Juda Group,Kaufman Bros., L.P.,KeyBanc Capital Markets Inc.,KGI Securities Co. Ltd.,Kintisheff Research,Landesbank Baden-Wuerttemberg Equity and Fixed Income Research,Lazard Capital Markets,Loop Capital Markets,Macquarie Research,Madison Williams and Company LLC,Melius Research LLC,MF Global UK Limited,Miller Tabak & Co., LLC,Mizuho Securities USA LLC,MKM Partners LLC,Morgan Keegan & Company,Morgan Stanley,Morningstar Inc.,Needham & Company,New Street Research LLP,Nomura Securities Co. Ltd.,Northland Capital Markets,Oppenheimer & Co. Inc.,Pacific Crest,Phillip Securities Pte Ltd,Piper Sandler Companies,Raymond James & Associates,RBC Capital Markets,Rodman & Renshaw, LLC,Rosenblatt Securities Inc.,Samsung Securities Co. Ltd.,Sanford C. Bernstein & Co., LLC,Signal Hill Capital Group LLC,Sterne Agee & Leach,Stifel, Equities Research,TD Cowen,Technology Research Group,ThinkEquity LLC,Thomas Weisel Equity Research,Ticonderoga Securities LLC,Tigress Financial Partners LLC,Topeka Capital Markets Inc.,Truist Securities,UBS Investment Bank,Valuation & Research Specialists,Wedbush Securities Inc.,Wells Fargo Securities, LLC,WestPark Capital, Inc.,WGZ BANK AG Westdeutsche Genossenschafts,William Blair & Company L.L.C.,Wolfe Research, LLC.,Wunderlich Securities Inc. |

| Hinweis |

|---|

|

Selected Data supplied by Standard & Poors

* Unabhängige Schätzung (Gewinnwachstum (in %)) ** Nettobargeldbestand bei negativen Schätzungen |