Schlumberger Limited

Technische Signale

| Signale Details | |

|---|---|

| WKN / ISIN | - / - |

| Börse | NYSE |

| Schluss | 40,32 |

| Konservatives Signal | - |

| MACD | |

| Momentum | |

| Bollinger Bands | |

| TBI | |

| Schnitt GD 90 |

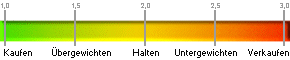

Analystenbewertung

| Bewertungstrend | aktuell | Vorwoche | Vormonat |

|---|---|---|---|

| Bewertung | 1,40 | 1,40 | 1,43 |

| Anzahl der Analysten | 30 | 30 | 30 |

| Kaufen | 19 | 19 | 18 |

| Übergewichten | 10 | 10 | 11 |

| Halten | 1 | 1 | 1 |

| Untergewichten | 0 | 0 | 0 |

| Verkaufen | 0 | 0 | 0 |

| Aktueller Durchschnitt von insgesamt 30 Analysten: 1,40 | |||

| Planzahlen (in EUR) | 2023 | 2024(e) | 2025(e) |

|---|---|---|---|

| Umsatz | 33,13 Mrd. | 36,98 Mrd. | 40,73 Mrd. |

| EBIT | 5,00 Mio. | 6,77 Mrd. | 7,92 Mrd. |

| EBITDA | 7,12 Mio. | 9,21 Mrd. | 10,59 Mrd. |

| Nettoverschuldung** | 8,37 Mrd. | 6,98 Mrd. | 5,32 Mrd. |

Umsatz |

EBIT |

EBITDA |

Nettoverschuldung** |

| Dividende | 2023 | 2024(e) | 2025(e) |

|---|---|---|---|

| Dividende / Aktie | 0,92 EUR | 1,09 USD | 1,20 USD |

| Dividendenrendite | 2,48% | 2,73% | 3,01% |

Dividende / Aktie (in USD) |

Dividendenrendite (in %) |

||

| Analystenhäuser |

|---|

| Argus Research Company,ATB Capital Markets,Atlantic Equities LLP,B. Riley Securities, Inc.,Baird,Baptista Research,Barclays,Benchmark Company,BMO Capital Markets Equity Research,BMO Capital Markets U.S. (Historical),BNP Paribas Exane,BofA Global Research,Boston Energy Research,Canaccord Genuity,Capital One Securities, Inc.,Carnegie Investment Bank AB,CFRA Equity Research,Citigroup Inc,Clarksons Platou Securities,Cleveland Research Company,CLSA,Coker Palmer Institutional,Cowen Securities LLC,Credit Agricole Securities (USA) Inc.,Credit Suisse,CRT Capital Group,D.A. Davidson & Co.,Daiwa Capital Markets America Inc.,Deutsche Bank,DNB Markets,Drexel Hamilton,Dz Bank Ag,Equisights,Erste Group Bank AG,Evercore ISI,FBR Capital Markets & Co.,G. Research, LLC,Goldman Sachs,Griffin Securities,Guggenheim Securities, LLC,HSBC,Iberia Capital Partners,Independent International Investment Research,ISI Group Inc.,J.P. Morgan,Jefferies LLC,Johnson Rice & Company, L.L.C.,KeyBanc Capital Markets Inc.,KLR Group Holdings, LLC,Loop Capital Markets,Macquarie Research,Madison Williams and Company LLC,Miller Tabak & Co., LLC,Morgan Keegan & Company,Morgan Stanley,Morningstar Inc.,Nomura Securities Co. Ltd.,Northland Capital Markets,ODDO BHF Corporate & Markets,Oppenheimer & Co. Inc.,Piper Sandler Companies,Pritchard Capital Partners, LLC,Raymond James & Associates,Raymond James Euro Equities,RBC Capital Markets,Sanford C. Bernstein & Co., LLC,Scotia Howard Weil,Scotiabank Global Banking and Market,Seaport Research Partners,Simmons & Company International,Societe Generale Cross Asset Research,Stephens, Inc.,Sterne Agee & Leach,Stifel Canada,Stifel, Equities Research,Susquehanna Financial Group, LLLP,TD Cowen,Truist Securities,Tudor, Pickering & Co. Securities, Inc.,UBS Investment Bank,Weeden & Co., LP,Wells Fargo Securities, LLC,William Blair & Company L.L.C.,Wolfe Research, LLC.,Yuanta Securities Korea Co., Ltd.,Zephirin Group, Inc. |

| Hinweis |

|---|

|

Selected Data supplied by Standard & Poors

* Unabhängige Schätzung (Gewinnwachstum (in %)) ** Nettobargeldbestand bei negativen Schätzungen |