TOTALENERGIES SE ACTIONS AU PORTEUR EO 2,50

Technische Signale

| Signale Details | |

|---|---|

| WKN / ISIN | - / FR0000120271 |

| Börse | Xetra |

| Schluss | 56,85 |

| Konservatives Signal | |

| MACD | |

| Momentum | |

| Bollinger Bands | |

| TBI | |

| Schnitt GD 90 |

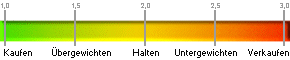

Analystenbewertung

| Bewertungstrend | aktuell | Vorwoche | Vormonat |

|---|---|---|---|

| Bewertung | 2,10 | 2,10 | 2,10 |

| Anzahl der Analysten | 21 | 21 | 21 |

| Kaufen | 7 | 7 | 7 |

| Übergewichten | 5 | 5 | 5 |

| Halten | 9 | 9 | 9 |

| Untergewichten | 0 | 0 | 0 |

| Verkaufen | 0 | 0 | 0 |

| Aktueller Durchschnitt von insgesamt 21 Analysten: 2,10 | |||

| Planzahlen (in EUR) | 2023 | 2024(e) | 2025(e) |

|---|---|---|---|

| Umsatz | 218,95 Mrd. | 206,31 Mrd. | 202,68 Mrd. |

| EBIT | 33,22 Mio. | 30,48 Mrd. | 31,45 Mrd. |

| EBITDA | 45,05 Mio. | 44,09 Mrd. | 43,43 Mrd. |

| Nettoverschuldung** | 18,91 Mrd. | 20,80 Mrd. | 21,86 Mrd. |

Umsatz |

EBIT |

EBITDA |

Nettoverschuldung** |

| Dividende | 2023 | 2024(e) | 2025(e) |

|---|---|---|---|

| Dividende / Aktie | 2,79 EUR | 3,46 USD | 3,68 USD |

| Dividendenrendite | 4,91% | 5,57% | 5,93% |

Dividende / Aktie (in USD) |

Dividendenrendite (in %) |

||

| Analystenhäuser |

|---|

| ABN AMRO Bank N.V.,Accountability Research Corporation,AlphaValue,Banco de Sabadell. S.A.,Banco Santander,Baptista Research,Barclays,BBVA Corporate and Investment Bank,Benchmark Company,Berenberg,BMO Capital Markets Equity Research,BNP Paribas Exane,BofA Global Research,Boston Energy Research,CA Cheuvreux,Canaccord Genuity,Cantor Fitzgerald Ireland,CFRA Equity Research,CIC Market Solutions (ESN),Citigroup Inc,CLSA,Collins Stewart plc,Credit Suisse,Daiwa Capital Markets Europe Limited,Daiwa Securities Co. Ltd.,Day By Day,Deutsche Bank,DNB Markets,Equisights,Erste Group Bank AG,Evercore ISI,Evolution Securities,Fearnley Securities,Financiële Diensten Amsterdam,Goldman Sachs,GSN North America,Hamburger Sparkasse AG,HSBC,ING Groep NV,Intesa Sanpaolo Equity Research,Investec Bank plc (UK),J.P. Morgan,Jefferies LLC,Jyske Bank A/S,Kepler Capital Markets,Kepler Cheuvreux,Macquarie Research,MF Global UK Limited,Mirabaud Securities Limited,Mirae Asset Securities Co., Ltd.,Mizuho Securities USA LLC,MKM Partners LLC,Morgan Stanley,Morningstar Inc.,Natixis S.A.,Nomura Securities Co. Ltd.,NWM Strategy,ODDO BHF Corporate & Markets,Oppenheimer & Co. Inc.,Panmure Liberum,Piper Sandler Companies,Raymond James & Associates,Raymond James Euro Equities,RBC Capital Markets,Redburn Atlantic,Sanford C. Bernstein & Co., LLC,Scotia Howard Weil,Scotiabank Global Banking and Market,Simmons & Company International,Societe Generale Cross Asset Research,Stifel Europe,TD Cowen,UBS Investment Bank,UniCredit Research,VTB Capital,WGZ BANK AG Westdeutsche Genossenschafts,Wolfe Research, LLC. |

| Hinweis |

|---|

|

Selected Data supplied by Standard & Poors

* Unabhängige Schätzung (Gewinnwachstum (in %)) ** Nettobargeldbestand bei negativen Schätzungen |