ESTEE LAUDER COMPAN. INC., THE REG. SHARES CLASS A DL -,01

Technische Signale

| Signale Details | |

|---|---|

| WKN / ISIN | - / US5184391044 |

| Börse | Stuttgart |

| Schluss | 59,80 |

| Konservatives Signal | |

| MACD | |

| Momentum | |

| Bollinger Bands | |

| TBI | |

| Schnitt GD 90 |

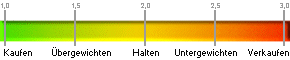

Analystenbewertung

| Bewertungstrend | aktuell | Vorwoche | Vormonat |

|---|---|---|---|

| Bewertung | 2,80 | 2,71 | 2,41 |

| Anzahl der Analysten | 30 | 31 | 29 |

| Kaufen | 3 | 4 | 7 |

| Übergewichten | 2 | 3 | 3 |

| Halten | 24 | 23 | 19 |

| Untergewichten | 0 | 0 | 0 |

| Verkaufen | 1 | 1 | 0 |

| Aktueller Durchschnitt von insgesamt 30 Analysten: 2,80 | |||

| Planzahlen (in EUR) | 2024 | 2024(e) | 2025(e) |

|---|---|---|---|

| Umsatz | 16,74 Mrd. | 15,60 Mrd. | 16,74 Mrd. |

| EBIT | 911,44 Tsd. | 1,47 Mrd. | 2,30 Mrd. |

| EBITDA | 2,11 Mio. | 2,27 Mrd. | 3,13 Mrd. |

| Nettoverschuldung** | 3,60 Mrd. | 4,84 Mrd. | 4,94 Mrd. |

Umsatz |

EBIT |

EBITDA |

Nettoverschuldung** |

| Dividende | 2024 | 2024(e) | 2025(e) |

|---|---|---|---|

| Dividende / Aktie | 2,45 EUR | 2,64 USD | 2,77 USD |

| Dividendenrendite | 4,05% | 3,99% | 4,18% |

Dividende / Aktie (in USD) |

Dividendenrendite (in %) |

||

| Analystenhäuser |

|---|

| Argus Research Company,Atlantic Equities LLP,B. Riley Securities, Inc.,Baptista Research,Barclays,Berenberg,BMO Capital Markets Equity Research,BMO Capital Markets U.S. (Historical),BofA Global Research,BTIG,Buckingham Research Group Inc.,Canaccord Genuity,Caris & Company,CFRA Equity Research,China Merchants Securities (HK) Co., Ltd,Citigroup Inc,CLSA,Consumer Edge Research, LLC,Credit Agricole Securities (USA) Inc.,Credit Suisse,CRT Capital Group,D.A. Davidson & Co.,Daishin Securities Co. Ltd.,Daiwa Securities Co. Ltd.,Deutsche Bank,Equisights,Eugene Investment & Securities Co Ltd.,Evercore ISI,Financiële Diensten Amsterdam,Goldman Sachs,Hanwha Investment & Securities Co., Ltd.,HSBC,Inside Research S.A.,J.P. Morgan,Jefferies LLC,KeyBanc Capital Markets Inc.,Korea Investment & Securities Co., Ltd.,Macquarie Research,Morgan Stanley,Morningstar Inc.,NH Investment & Securities Co., Ltd.,Oppenheimer & Co. Inc.,Piper Sandler Companies,Raymond James & Associates,RBC Capital Markets,Redburn Atlantic,Samsung Securities Co. Ltd.,Sanford C. Bernstein & Co., LLC,Shinhan Investment Corp.,Societe Generale Cross Asset Research,Sterne Agee & Leach,Stifel, Equities Research,Sturdivant & Co., Inc.,TD Cowen,Telsey Advisory Group LLC,Tiburon Research Group,UBS Investment Bank,Wedbush Securities Inc.,Weeden & Co., LP,Wells Fargo Securities, LLC,Zephirin Group, Inc. |

| Hinweis |

|---|

|

Selected Data supplied by Standard & Poors

* Unabhängige Schätzung (Gewinnwachstum (in %)) ** Nettobargeldbestand bei negativen Schätzungen |